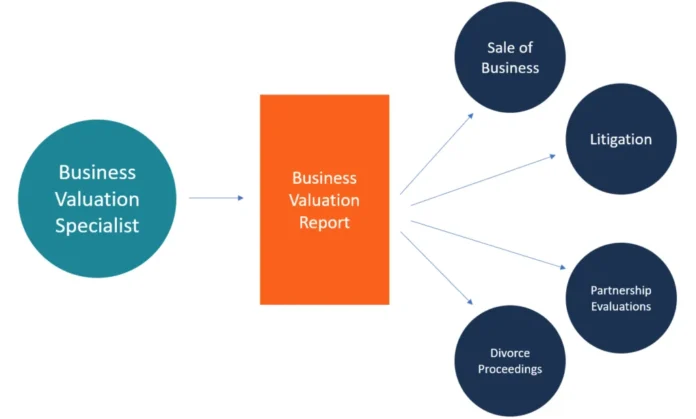

A business valuation consultant’s job is to assess the value of a business. While a brokers job is a bit different, it is important to have the best representation possible. A good broker will be familiar with your industry, your financials, and the characteristics of your business. They will also have an opinion on whether your business is worth pursuing. The consultant will also act as a broker, advising you on the selling price if you’re planning to sell.

A good business valuation firm will be highly skilled and experienced

A good business valuation firm will be highly skilled and experienced. The expert will likely have several credentials, including the American Institute of Certified Public Accountants, the Institute of Business Appraisers, and the American Society of Appraisers. A qualified business valuation firm will also have experience in the industry. A certified professional will know the best method to use and be able to accurately determine a company’s value.

Make sure you’re hiring a highly qualified and experienced individual with relevant professional experience.

The process of hiring a business valuation consultant is an important decision, and you need to make sure you’re hiring a highly qualified and experienced individual with relevant professional experience. While it may be tempting to go with the lowest bidder, this approach can backfire if the situation goes to court.

A qualified, certified business valuation professional will be able to offer accurate estimates based on comparable sales.

A qualified, certified business valuation professional will be able to offer accurate estimates based on comparable sales. And don’t forget that your time is money. You want to spend your time wisely, and a certified professional will be able to help you make the right choice.

A business valuation firm will also help you understand the value of your business

A business valuation firm will also help you understand the value of your business. This will allow you to maximise the value of your business. After all, it’s better to have a good idea of what your company is worth than to ignore it. A business valuation consultant is your best tool to help you decide whether to sell it or keep it as it is. If you’re not sure where to start, a professional can provide you with an overview of the process and answer all of your questions.

Will be able to benchmark your company against competitors

A business valuation is essential for the health of your company. It will help you determine where you’re at risk and where you can grow. A good expert will be able to benchmark your company against competitors. It will also help you plan your succession. It can be the most valuable asset you have, so it’s imperative that you find a professional like Cayenne Consulting who’s willing to share his expertise with you.

Check their certification

The next thing to look for in a business valuation consultant is their certification. A certified analyst has the highest professional standards and will give you a more credible result than a non-certified one. For example, a certified analyst has been trained to make decisions based on these standards. In addition, a business valuation consultant will ensure that his work is done to the highest professional standards. This is vital for your company’s success.

An expert in business valuation is essential in many situations. Having a Chartered Accountant or Certified Management Accountant (CMA) is essential for the professional’s credibility. A certified professional can also keep up with the latest issues in the valuation industry. A qualified expert can be invaluable for the long term. You may be considering selling your business, but you don’t want to sell it at a loss. A qualified appraiser can help you decide whether you should sell your company or keep it for yourself.

The more experience a business valuation consultant has, the lower the cost. This is critical for determining the exact value of a business. A higher fee may indicate more experience, but a cheaper fee may be worth the added value. A lower rate may mean a more competent consultant can provide better advice. But if you’re not sure, talk to your board members and advisors. The advice of your advisors and consultants will be invaluable to your business.