To alleviate the monetary effect of COVID-19 episode, the Reserve Bank of India (RBI) on Friday again diminished the key loaning rate by notable degrees of 40 premise focuses from 4.4 percent to 4 percent.

Repo rate is the key loan cost at which the RBI loans momentary assets to business banks.

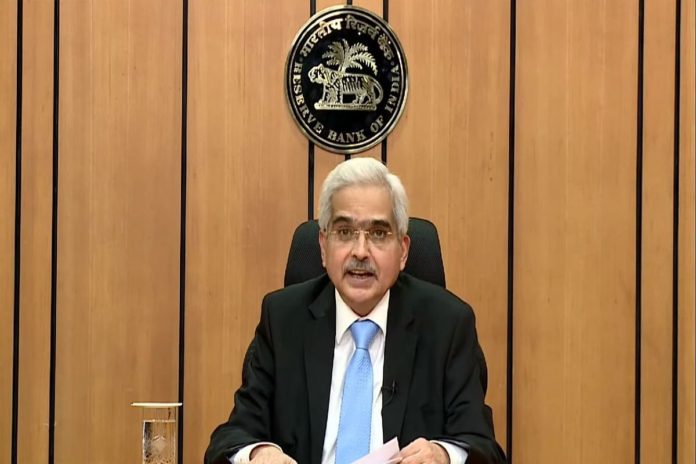

The converse repo rate has likewise been diminished to 3.35 percent, the RBI Governor Shaktikanta Das said in an instructions today. Prior, the opposite repo rate was at 3.75 percent, when it was cut by 25 premise focuses in April.

Das said the national bank would keep up accommodative position till development resuscitates.

Other than decreasing the key loaning rates, the pinnacle bank took other significant choices remembering the overwhelming financial effect of COVID-19 pandemic.

In one such choice, the RBI has expanded the ban on intrigue installments on all term credits for an additional three months. It additionally took into account reimbursement of amassed enthusiasm by virtue of the ban through FY21.

“Three-month ban we permitted on term credits and on working capitals we permitted certain relaxations. Taking into account the augmentation of the lockdown and proceeding with disturbance by virtue of COVID-19, these measures are as a rule additionally reached out by an additional three months from June 1 to August 31,” Das said at the preparation.

Further, the Group Exposure Limit of banks has been expanded from 25 percent to 30 percent of qualified capital base for empowering the corporates to meet their subsidizing necessities from banks. As far as possible will be relevant up to 30 June, 2021.

The RBI has additionally chosen to loosen up rules overseeing withdrawal from Consolidated Sinking Fund (CSF) while simultaneously, guaranteeing exhaustion of store balance is done judiciously. This will empower states to meet around 45 percent of recovery of their market borrowings which are expected in 2020-21.

The measures declared today have been partitioned into four classes: To improve working of business sectors; to help fares and imports; to ease monetary worry by giving alleviation on obligation overhauling and better access to working capital; and to ease budgetary limitations looked by state governments.

In the interim, the Reserve Bank of India will expand a credit line of Rs 15,000 crore to the Export-Import (EXIM) Bank of India.

The declaration is a piece of the RBI’s most recent measures to support organizations and the economy tide over the coronavirus emergency.

The Export-Import Bank of India gives budgetary help to exporters and shippers with the end goal of advancing the nation’s global exchange. EXIM Bank overwhelmingly depends on remote money assets raised from universal budgetary markets for its activities and it is confronting difficulties to bring assets up in global deb capital markets in the midst of the coronavirus emergency.

The RBI representative, in his location, said that modern creation shrank by near 17 percent in March with assembling action somewhere near 21 percent. Yield of center businesses have shrunk by 6.5 percent.

In any case, he called attention to that in the midst of this circling anguish, horticulture and associated exercises have given an encouraging sign on the rear of an expansion of 3.7 percent in food grain creation to another record.

He included that India’s outside trade saves have expanded by 9.2 billion during 2020-21 from April 1 onwards. “Up until this point, up to 15 May, remote trade saves remain at 487 billion US dollars,” Das said.

Shaktikanta Das further educated that the GDP development in 2020-21 is required to stay in the negative classification with some get in second half.

Off late, a few banks and rating organizations have figure an intense fall in India’s GDP development rate, he said.

Instructions the media, Das said that the pandemic has seriously affected the worldwide economy, including India’s. He said that the Coronavirus pandemic has managed a devastating hit to the interest.

“High recurrence markers focuses to crumple popular in March,” the RBI Governor said.

Das, be that as it may, demonstrated confidence and certainty on the flexibility of the Indian economy, and stated: “We have confidence on the Indian economy.”

The RBI representative likewise expressed that the macroeconomic effect of the pandemic is ending up being more serious than at first envisioned.

“The MPC is of the view that the macroeconomic effect of the pandemic is ending up being more serious than at first envisioned, and different divisions of the economy are encountering intense pressure.”

“The effect of the stun has been exacerbated by the collaboration of flexibly interruptions and request pressure. Past the devastation of monetary and money related movement, employment and wellbeing are seriously influenced.”

He said that it is important to ease money related conditions further which will encourage the progression of assets at moderate rates and resuscitate ‘creature spirits’.

The International Monetary Fund’s (IMF) worldwide development projections have uncovered that in 2020, the worldwide economy is required to dive into the most noticeably terrible downturn since ‘The Great Depression’.

IMF Economic Counselor has named it ‘The Great lockdown’ assessing total misfortune to worldwide GDP at around 9 trillion US dollars, which is more prominent than the economies of Japan and Germany joined.

Notwithstanding, India is among the bunch of nations that is anticipated to stick on, fairly questionably, to a positive development pace of 1.9 percent. This is the most noteworthy development rate among the G-20 economies as assessed by the IMF.